Energy Transition is a Metals Transition

The global shift towards the energy transition is a massive undertaking that hinges on numerous technological and societal advances. Pervasive to almost all aspects of the energy transition, however, is first and foremost a resource availability challenge. The true global energy transition is at its core a metals transition.

The International Energy Agency (IEA) forecasts a 500% surge in critical mineral consumption to achieve an 80% global renewable energy penetration [1]. This increase is driven by emerging energy transition technologies’ escalating demand for minerals. For instance, the manufacturing of electric cars demands six times more mineral inputs than their conventional counterparts. At the same time, offshore wind plants require 13 times more mineral resources than a similarly sized gas-fired facility [2].

Platinum group metals (PGMs) and copper are among the critical minerals that are anticipated to suffer supply shortages in the near future. PGMs, comprising six rare elements, are employed across diverse industries, notably as industrial catalysts and autocatalysts. With tightening global emissions standards, PGM demand is expected to escalate. PGMs are also utilized in emerging technologies, such as hydrogen fuel cells, electrolyzers, and many electrochemical processes, where no other materials have demonstrated comparable activity, selectivity, and stability.

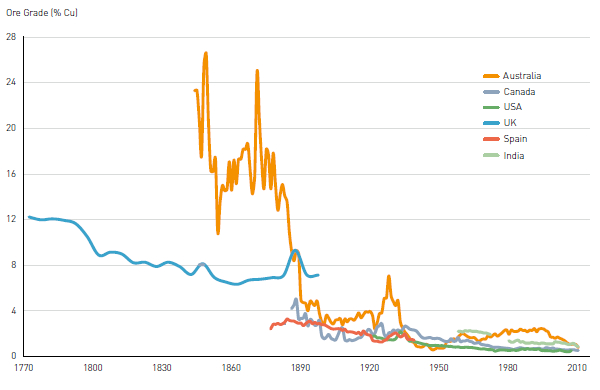

As for copper, its use in electric vehicles (EVs), charging infrastructure, photovoltaics (PVs), wind turbines, and batteries renders it a cornerstone metal for the energy revolution, but the supply of copper is dwindling. The copper content in the copper ore has dropped from 4% at the start of the century to less than 1% today. Because of the declining ore grades and mine closures, production from existing copper mines is expected to decline at a CAGR of 4.7% between 2026–2030. Meanwhile, the permitting process for a new mine has taken a much longer duration, stretching from 3–4 years in 1956 to 16 years today for major copper projects [3]. Given those factors, the impending copper deficit looms as early as 2025 [4].

Geopolitical and trade issues have further strained the availability of metal resources. China, boasting 40% of the world’s copper processing capacity, maintains a dominant position in the copper market. Russia is the second-largest producer and fourth-largest exporter of PGMs. The ongoing Russia-Ukraine conflict has resulted in flight bans and sanctions on Russian PGM supply, intensifying pressure on the PGMs supply chain.